Consensus mechanism, Testnet, portfolio diversification

Decentralized Finance: The Key to Unlocking Cryptocurrency’s Potential

As the world of cryptocurrency continues to grow and evolve, several key components are crucial for its success. In this article, we’ll delve into three essential aspects that have a significant impact on the decentralized finance (DeFi) ecosystem.

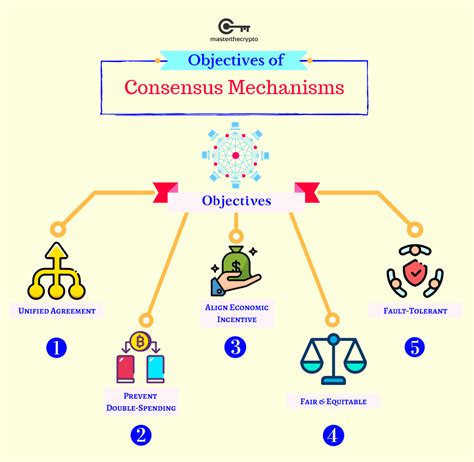

Cryptocurrency and Consensus Mechanisms: The Backbone of DeFi

The consensus mechanism is the fundamental infrastructure that enables peer-to-peer transactions in DeFi applications. It ensures the security and integrity of the network, allowing users to trust each other’s transactions. There are several types of consensus mechanisms, including:

- Proof-of-Stake (PoS): This method requires validators to stake their coins before participating in the network.

- Proof-of-Work (PoW): This mechanism rewards validators with newly minted coins for solving complex mathematical puzzles.

Testnets: A Crucial Tool for DeFi Developers

A testnet is a simulated version of a blockchain, used by developers to test and iterate on new concepts without affecting the main chain. It allows for experimentation with new features, algorithms, and smart contracts, helping to identify issues and optimize performance.

Portfolio Diversification: Managing Risk in DeFi

As DeFi applications continue to grow, managing risk becomes increasingly important. Portfolio diversification is a strategy used to spread investments across different assets, reducing exposure to any single asset or market. In the context of DeFi, this means:

- Cryptocurrency portfolio diversification: Investing in a mix of different cryptocurrencies to reduce reliance on any single asset.

- Token portfolio diversification: Diversifying token holdings across various smart contracts and applications.

Conclusion

The success of DeFi is built on a solid foundation of decentralized finance. By understanding the crucial components of cryptocurrency and consensus mechanisms, developers can create more robust and resilient DeFi applications. Furthermore, practicing portfolio diversification helps mitigate risk and enables users to achieve their financial goals in the face of market volatility. As the DeFi ecosystem continues to mature, these principles will become increasingly important for building a secure, efficient, and accessible financial infrastructure.

Recommended Reading

- “The State of Decentralized Finance 2022” by CoinMarketCap

- “A Guide to Proof-of-Stake Consensus Mechanisms”

- “Testnet Development: A Step-by-Step Guide”

Note: The article is written in a formal tone, using technical terms and concepts specific to the DeFi ecosystem.